Friday, December 19, 2008

goldsilvervault.com

Coming in a few days! Come see the premier gold and silver vault storage company at goldsilvervault.com

Thursday, December 4, 2008

A Memorable Delivery Experience

A Memorable Delivery Experience

For those who remember, I wrote a letter asking about taking delivery from the COMEX. Well I would like to tell you about a very educational experience.

Recently, we took a delivery from the COMEX. The process was a bit cumbersome but very enlightening. First, I would like to say that the process of dealing with the custodians was very professional. However, let me begin my story of amazement.

The silver and gold were to be prepared and packaged for shipment by the existing custodian. As I understand it, this was part of the delivery out fee. We will get back to the packaging later.

The metal was arranged for a pick up and delivery using a very well known armored carrier. Initially, everything was going as planned. After the metal was gathered from various custodians, it was on its way to one of our facilities. We were in contact with the armored carrier who laid out a time frame of when to expect arrival of the armored truck. We were told that shipment arrivals usually occur in the morning and with plenty of notice.

This is when the story gets interesting.

Three days after the shipment leaves New York, I get a call at 4:50 pm from one of our vault managers. He mentioned if the armored carrier ever called with a delivery time. I told him the armored carrier was supposed to call us with an estimated time of arrival. Our vault manger paused and said, “I have a big armored truck sitting outside.” He mentioned to me later that the truck was fairly weighed down in the back with the headlights shooting up in the air. Anyone in the armored transportation business would say at this point we have a problem. An unscheduled delivery, 10 minutes before the vault is locked down, darkness setting in, and a truck with an obviously big payload sounds like a setting for a Jessie James novel.

But wait it gets better.

The packaging which the COMEX custodian charged for consisted of pallets of silver with metal bands over the bars. The gold bars were in a simple cardboard box. There was no shrink wrap over the pallets or secured container holding the gold bars. It seemed like a $10 glass bowl bought on the internet was better prepared for shipment than this extremely valuable cargo.

Somehow during the transportation, the bands on the pallets holding the silver bars broke and some of the bars were scattered in the armored truck. To make matters worse there was no invoice providing an itemized list of bars and their serial numbers. In fact on the invoice, the delivery date was to be two days later.

Typically, this is a point when you get someone in charge on the phone. Well, that is what we did. We contacted the carrier’s regional transportation official. We told him in most cases a delivery like this is usually not accepted due to risk and liability. After a few words the carrier’s manager said if you do not take delivery we will send the metal back to our regional office, load it on a trailer, and send it back to New York.

When you are talking several tons of metal, you think twice about moving this around. After we inspected the metal for damage and counted the bars, we accepted the shipment.

Please understand taking delivery from the COMEX entails some risk. But for many proponents of gold and silver to simply say “have the metal shipped to a business, store it at home, or do not let a third party handle or store your metal,” investors might consider this experience. When you have armed guards show up at your doorstep with a shipment, they are trained to carry out a certain function. They are not there to greet you with a smile like a mailman or newspaper delivery boy.

Our armored facility is very well equipped to handle deliveries whether scheduled or unscheduled. Fortunately, the experience of our management team turned a potentially costly situation into safe and secure delivery.

Do not let this story dissuade you from taking delivery off the COMEX. The above story is not your typical delivery and most armored carriers provide a very secure environment for its cargo and the items held in their vault. For us the process is routine. Our facility can support you in preparing the three items requested by the COMEX custodian for delivery, arranging for a pick up and transportation, and securing valuable assets in a fully insured/segregated facility.

Bob Coleman

profitsplus@cableone.net

http://profitspluscapital.blogspot.com/

For those who remember, I wrote a letter asking about taking delivery from the COMEX. Well I would like to tell you about a very educational experience.

Recently, we took a delivery from the COMEX. The process was a bit cumbersome but very enlightening. First, I would like to say that the process of dealing with the custodians was very professional. However, let me begin my story of amazement.

The silver and gold were to be prepared and packaged for shipment by the existing custodian. As I understand it, this was part of the delivery out fee. We will get back to the packaging later.

The metal was arranged for a pick up and delivery using a very well known armored carrier. Initially, everything was going as planned. After the metal was gathered from various custodians, it was on its way to one of our facilities. We were in contact with the armored carrier who laid out a time frame of when to expect arrival of the armored truck. We were told that shipment arrivals usually occur in the morning and with plenty of notice.

This is when the story gets interesting.

Three days after the shipment leaves New York, I get a call at 4:50 pm from one of our vault managers. He mentioned if the armored carrier ever called with a delivery time. I told him the armored carrier was supposed to call us with an estimated time of arrival. Our vault manger paused and said, “I have a big armored truck sitting outside.” He mentioned to me later that the truck was fairly weighed down in the back with the headlights shooting up in the air. Anyone in the armored transportation business would say at this point we have a problem. An unscheduled delivery, 10 minutes before the vault is locked down, darkness setting in, and a truck with an obviously big payload sounds like a setting for a Jessie James novel.

But wait it gets better.

The packaging which the COMEX custodian charged for consisted of pallets of silver with metal bands over the bars. The gold bars were in a simple cardboard box. There was no shrink wrap over the pallets or secured container holding the gold bars. It seemed like a $10 glass bowl bought on the internet was better prepared for shipment than this extremely valuable cargo.

Somehow during the transportation, the bands on the pallets holding the silver bars broke and some of the bars were scattered in the armored truck. To make matters worse there was no invoice providing an itemized list of bars and their serial numbers. In fact on the invoice, the delivery date was to be two days later.

Typically, this is a point when you get someone in charge on the phone. Well, that is what we did. We contacted the carrier’s regional transportation official. We told him in most cases a delivery like this is usually not accepted due to risk and liability. After a few words the carrier’s manager said if you do not take delivery we will send the metal back to our regional office, load it on a trailer, and send it back to New York.

When you are talking several tons of metal, you think twice about moving this around. After we inspected the metal for damage and counted the bars, we accepted the shipment.

Please understand taking delivery from the COMEX entails some risk. But for many proponents of gold and silver to simply say “have the metal shipped to a business, store it at home, or do not let a third party handle or store your metal,” investors might consider this experience. When you have armed guards show up at your doorstep with a shipment, they are trained to carry out a certain function. They are not there to greet you with a smile like a mailman or newspaper delivery boy.

Our armored facility is very well equipped to handle deliveries whether scheduled or unscheduled. Fortunately, the experience of our management team turned a potentially costly situation into safe and secure delivery.

Do not let this story dissuade you from taking delivery off the COMEX. The above story is not your typical delivery and most armored carriers provide a very secure environment for its cargo and the items held in their vault. For us the process is routine. Our facility can support you in preparing the three items requested by the COMEX custodian for delivery, arranging for a pick up and transportation, and securing valuable assets in a fully insured/segregated facility.

Bob Coleman

profitsplus@cableone.net

http://profitspluscapital.blogspot.com/

Tuesday, November 18, 2008

The What, Why’s, and How’s of Physical Precious Metals

The What, Why’s, and How’s of Physical Precious Metals

The What

The first and foremost question is what are you investing in? Are you putting capital into physical metal that stands alone and outside the monetary system? This is the primary function of owning precious metals in the first place yet many we speak with seem to misunderstand or interpret this crucial factor!

Restated we might ask do you understand the difference between investing and participating in physical gold and silver. In my view, investing has the following characteristics:

Invest in a known form of physical gold and silver this can be coins or bars and sizes up to deliverable commercial silver and gold as held on the Comex.

If you elect to own metal in individual or commercial form make certain of the following:

Have the precious metal stored in an armored and insured vault.

Have the custodian independent from the financial system.

Provide the investor a choice upon distribution, cash or physical metal.

Offer accessibility to the metal and have prearranged options for delivery if client wants the metal in hand.

On the other hand, participating offers the following characteristics:

Ability to follow the price of the precious metals.

Settlement is normally in cash or currency with little emphasis on actually delivering in smaller deliverable form.

The program is directly tied to the financial or bullion dealer system.

Accessibility to the metal is hindered by the custodian in the form of sub-custodian or bailment relationships. Also, participants have to factor serious tax consequences if the program offers the ability to take physical delivery in jurisdictions where Value Added Tax is an issue.

In other words participation programs buy and store mostly large bars of metal with the focus on cost efficiency and effectiveness for the program itself.

If your preference is participation then understand the risks to your capital.. If your preference is investing then understand the risks of accessibility. Programs may have the best intention but if you can not get to your metal or your metal can not be delivered you may not have it just when you need it the most!

The Why

With the recent chaos in the financial markets one must examine their entire portfolio. Yes, that includes precious metals. For those who are involved in precious metals, what I am referring to is the form in which you are pursuing (gold and silver). Although, many own the physical metal and store it “close to home”, many others use conduits to gain participation in this sector. With all the options in the market place, lack of understanding can breed mistakes. I believe we are entering a period in which these mistakes may become very costly. However, for the investors who are involved in the bullion, the distinctions between the numerous programs are extraordinary and need to be recognized.

Lets first start with the reasons why you believe in gold or silver. The basic premise is to diversify from inflation, systemic risk, or political uncertainty. Ask yourself are my gold or silver investments in bullion attainable and accessible?

Again, the distinction depends whether you are participating or investing in the bullion itself. Review your agreements and documents, ask questions that pertain to you and your portfolio needs(for example understand the difference between fully allocated and fully segregated), and most importantly ask the precious metals program what would happen under extreme circumstances. Understanding your investment and how it operates may avoid unpleasant surprises in the future.

The How

In this dynamic political and economic climate, what sounds reasonable today may not be appropriate in the future. For example, capital and exchange controls could hamper overseas programs and your ability to receive the metal. How do you know for sure that the bullion vault is not leasing out your gold? How fast can companies turn large bars of gold and silver into deliverable ounces?

In other words the program must have already considered issues such as confiscation, changes in economic/political policy, systemic concerns within the central banking system, and geo-political events. The precious metal programs that have built a model that is flexible and adaptable to change will have the ability to overcome these challenges and protect its investors.

Three years ago, I reviewed nearly every gold and silver program in the world. None met my stringent standards and fiduciary concerns. A few of which were:

accessibility and transparency of storage,

clients assets were held in allocated form not fully segregated form, and

communication or delivery between the program or vault and the customer.

Your objective must be to invest in the precious metals not merely participate in price movement.

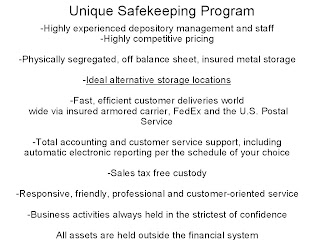

Therefore I created a set of unique programs for you – the precious metals investor.

The structure, which puts the needs of the investor first, is simple yet very competitive. We offer storage and investment solutions that can be tailored to each individual throughout world. We have taken into account many common concerns of precious metal investors such as viewing one’s holdings, having ideal alternative storage locations, and providing an insured, secured and fully segregated vaulting environment. Understanding the current political and economic environment is only part of the foresight included in our approach.

In summary, part of investing in the bullion markets includes understanding the market environment, eliminating as much risk as possible, and protecting your assets in a prudent manner.

To find more information visit my blog at http://profitsplusecaptial.blogspot.com or send an email to profitsplus@cableone.net We can answer any of your portfolio questions and quickly provide you many ways to purchase your very own gold and silver. We will completely furnish insured, fully segregated, and armored storage for you. At that point you will realize just how profitable and vital ownership of physical gold and silver truly is.

Bob Coleman

http://profitspluscapital.blogspot.com/

The What

The first and foremost question is what are you investing in? Are you putting capital into physical metal that stands alone and outside the monetary system? This is the primary function of owning precious metals in the first place yet many we speak with seem to misunderstand or interpret this crucial factor!

Restated we might ask do you understand the difference between investing and participating in physical gold and silver. In my view, investing has the following characteristics:

Invest in a known form of physical gold and silver this can be coins or bars and sizes up to deliverable commercial silver and gold as held on the Comex.

If you elect to own metal in individual or commercial form make certain of the following:

Have the precious metal stored in an armored and insured vault.

Have the custodian independent from the financial system.

Provide the investor a choice upon distribution, cash or physical metal.

Offer accessibility to the metal and have prearranged options for delivery if client wants the metal in hand.

On the other hand, participating offers the following characteristics:

Ability to follow the price of the precious metals.

Settlement is normally in cash or currency with little emphasis on actually delivering in smaller deliverable form.

The program is directly tied to the financial or bullion dealer system.

Accessibility to the metal is hindered by the custodian in the form of sub-custodian or bailment relationships. Also, participants have to factor serious tax consequences if the program offers the ability to take physical delivery in jurisdictions where Value Added Tax is an issue.

In other words participation programs buy and store mostly large bars of metal with the focus on cost efficiency and effectiveness for the program itself.

If your preference is participation then understand the risks to your capital.. If your preference is investing then understand the risks of accessibility. Programs may have the best intention but if you can not get to your metal or your metal can not be delivered you may not have it just when you need it the most!

The Why

With the recent chaos in the financial markets one must examine their entire portfolio. Yes, that includes precious metals. For those who are involved in precious metals, what I am referring to is the form in which you are pursuing (gold and silver). Although, many own the physical metal and store it “close to home”, many others use conduits to gain participation in this sector. With all the options in the market place, lack of understanding can breed mistakes. I believe we are entering a period in which these mistakes may become very costly. However, for the investors who are involved in the bullion, the distinctions between the numerous programs are extraordinary and need to be recognized.

Lets first start with the reasons why you believe in gold or silver. The basic premise is to diversify from inflation, systemic risk, or political uncertainty. Ask yourself are my gold or silver investments in bullion attainable and accessible?

Again, the distinction depends whether you are participating or investing in the bullion itself. Review your agreements and documents, ask questions that pertain to you and your portfolio needs(for example understand the difference between fully allocated and fully segregated), and most importantly ask the precious metals program what would happen under extreme circumstances. Understanding your investment and how it operates may avoid unpleasant surprises in the future.

The How

In this dynamic political and economic climate, what sounds reasonable today may not be appropriate in the future. For example, capital and exchange controls could hamper overseas programs and your ability to receive the metal. How do you know for sure that the bullion vault is not leasing out your gold? How fast can companies turn large bars of gold and silver into deliverable ounces?

In other words the program must have already considered issues such as confiscation, changes in economic/political policy, systemic concerns within the central banking system, and geo-political events. The precious metal programs that have built a model that is flexible and adaptable to change will have the ability to overcome these challenges and protect its investors.

Three years ago, I reviewed nearly every gold and silver program in the world. None met my stringent standards and fiduciary concerns. A few of which were:

accessibility and transparency of storage,

clients assets were held in allocated form not fully segregated form, and

communication or delivery between the program or vault and the customer.

Your objective must be to invest in the precious metals not merely participate in price movement.

Therefore I created a set of unique programs for you – the precious metals investor.

The structure, which puts the needs of the investor first, is simple yet very competitive. We offer storage and investment solutions that can be tailored to each individual throughout world. We have taken into account many common concerns of precious metal investors such as viewing one’s holdings, having ideal alternative storage locations, and providing an insured, secured and fully segregated vaulting environment. Understanding the current political and economic environment is only part of the foresight included in our approach.

In summary, part of investing in the bullion markets includes understanding the market environment, eliminating as much risk as possible, and protecting your assets in a prudent manner.

To find more information visit my blog at http://profitsplusecaptial.blogspot.com or send an email to profitsplus@cableone.net We can answer any of your portfolio questions and quickly provide you many ways to purchase your very own gold and silver. We will completely furnish insured, fully segregated, and armored storage for you. At that point you will realize just how profitable and vital ownership of physical gold and silver truly is.

Bob Coleman

http://profitspluscapital.blogspot.com/

Friday, October 24, 2008

October 23, 2008

Re: Response from the CME Group

Ladies and Gentlemen:

We have received an outpouring of support and interest from the recent letter I sent the CME and the CFTC. Before I get into their response, I would like to mention that many investors, individuals, and institutions are perplexed by the unusually tight (in some cases non-existent) supply of investable/deliverable silver in the world. I find it unusual that silver remains labeled an industrial metal when in fact it has become so scarce for investors.

The reasons for owning gold and silver have been well published by many individuals. What I am more concerned with is the inability to invest in an asset class in which there is currently very little availability. Unlike any other conventional market, gold and silver, seem to be getting harder to find as the paper price drops further.

I am worried about the confidence and perception of the paper metal markets. With the physical supply shortage being real and physical demand being so strong, the concern is that individuals and institutions may start to test the exchange’s credibility through outright demand of their inventory. Unlike the government’s bailout programs for many paper instruments, I do not see that type of shared support for the commodities market, especially precious metals.

Trust is a very fragile commodity, itself. Once broken, it may never be restored. That is the risk the paper metal markets are telling me at this point. Unless there is underlying or fundamental reasons beyond margin calls for the drop in paper prices, my intuition is telling me that something is very wrong. Is someone or some entity building a large position in the precious metals? If that is the case, then you may be concerned about the ability to get physical metal in the future. That is why I wrote the letter to the CFTC and CME Group.

Again, the risks are real and individuals must understand the true difference between the physical and paper world. The paper is only as good as what backs it. In this period of history it is evident many investors are now asking “who can I really trust”. It is that mentality that places a premium on the physical metal versus a paper certificate. As this credit crisis unfolds and the bailouts continue, it is only logical that many exchanges will be tested. As a concerned investor, the last thing I want is to be holding a paper promise that may not be fulfilled.

I would like to thank the CME Group for their quick response. In full disclosure, this was their actual reply to me. I am still waiting to hear from the CFTC.

Bob:

Thank you for your October 17, 2008 email where you inquired:

- "...I would like to buy and take physical delivery of 1 to 5 million ounces

of silver a month on a consistent basis...."

The monthly volume (200/1000 contracts) which you would wish to take delivery is currently within the Exchanges Silver “Expiration Month Limit” and thereby acceptable to the Exchange.

-“… Would there be any obstacles or resistence from either the CME Group/COMEX or the CFTC…”

I can only reply for the CME Group and not the CFTC.

As long as any customer follows the Exchange Rules, there would not be a problem.

Vice President

Market Surveillance

CME GROUP

It is obvious that the rules can change at any moment and this is a concern to many individuals. For now, I would strongly suggest if you were thinking about owning silver, the COMEX is certainly the most cost efficient method of procuring the metal. Please keep in mind that transportation and storage of these bars may involve a cost. These costs have to be weighed in your decision making. We can provide an effective and efficient alternative for those who are not interested in dealing with these issues yet want to participate in the precious metals.

Our programs are determined to follow the rules of the exchange and take physical delivery of their inventory for as long as possible. The structure of our programs and vaulting facilities are very unique and have been designed to fully insure and segregate all physical precious metals. The storage is independent from the financial and bullion dealer system. We specialize in providing private storing, safeguarding, and viewing of your assets. We have made arrangements with armored transportation carriers to pick up, transport, and store the metal to many of our available vaults. Please go to http://profitspluscapital.blogspot.com/ for more information.

For individuals, investment professionals, or institutions who are concerned about the unusual nature between paper and physical gold and silver prices and wish to create a more balanced environment that reflects the true supply and demand imbalances in the market place, please contact me at 208-468-3600 or email me at profitsplus@cableone.net.

Bob Coleman

Managing Member, Profits Plus Capital Management, LLC

Re: Response from the CME Group

Ladies and Gentlemen:

We have received an outpouring of support and interest from the recent letter I sent the CME and the CFTC. Before I get into their response, I would like to mention that many investors, individuals, and institutions are perplexed by the unusually tight (in some cases non-existent) supply of investable/deliverable silver in the world. I find it unusual that silver remains labeled an industrial metal when in fact it has become so scarce for investors.

The reasons for owning gold and silver have been well published by many individuals. What I am more concerned with is the inability to invest in an asset class in which there is currently very little availability. Unlike any other conventional market, gold and silver, seem to be getting harder to find as the paper price drops further.

I am worried about the confidence and perception of the paper metal markets. With the physical supply shortage being real and physical demand being so strong, the concern is that individuals and institutions may start to test the exchange’s credibility through outright demand of their inventory. Unlike the government’s bailout programs for many paper instruments, I do not see that type of shared support for the commodities market, especially precious metals.

Trust is a very fragile commodity, itself. Once broken, it may never be restored. That is the risk the paper metal markets are telling me at this point. Unless there is underlying or fundamental reasons beyond margin calls for the drop in paper prices, my intuition is telling me that something is very wrong. Is someone or some entity building a large position in the precious metals? If that is the case, then you may be concerned about the ability to get physical metal in the future. That is why I wrote the letter to the CFTC and CME Group.

Again, the risks are real and individuals must understand the true difference between the physical and paper world. The paper is only as good as what backs it. In this period of history it is evident many investors are now asking “who can I really trust”. It is that mentality that places a premium on the physical metal versus a paper certificate. As this credit crisis unfolds and the bailouts continue, it is only logical that many exchanges will be tested. As a concerned investor, the last thing I want is to be holding a paper promise that may not be fulfilled.

I would like to thank the CME Group for their quick response. In full disclosure, this was their actual reply to me. I am still waiting to hear from the CFTC.

Bob:

Thank you for your October 17, 2008 email where you inquired:

- "...I would like to buy and take physical delivery of 1 to 5 million ounces

of silver a month on a consistent basis...."

The monthly volume (200/1000 contracts) which you would wish to take delivery is currently within the Exchanges Silver “Expiration Month Limit” and thereby acceptable to the Exchange.

-“… Would there be any obstacles or resistence from either the CME Group/COMEX or the CFTC…”

I can only reply for the CME Group and not the CFTC.

As long as any customer follows the Exchange Rules, there would not be a problem.

Vice President

Market Surveillance

CME GROUP

It is obvious that the rules can change at any moment and this is a concern to many individuals. For now, I would strongly suggest if you were thinking about owning silver, the COMEX is certainly the most cost efficient method of procuring the metal. Please keep in mind that transportation and storage of these bars may involve a cost. These costs have to be weighed in your decision making. We can provide an effective and efficient alternative for those who are not interested in dealing with these issues yet want to participate in the precious metals.

Our programs are determined to follow the rules of the exchange and take physical delivery of their inventory for as long as possible. The structure of our programs and vaulting facilities are very unique and have been designed to fully insure and segregate all physical precious metals. The storage is independent from the financial and bullion dealer system. We specialize in providing private storing, safeguarding, and viewing of your assets. We have made arrangements with armored transportation carriers to pick up, transport, and store the metal to many of our available vaults. Please go to http://profitspluscapital.blogspot.com/ for more information.

For individuals, investment professionals, or institutions who are concerned about the unusual nature between paper and physical gold and silver prices and wish to create a more balanced environment that reflects the true supply and demand imbalances in the market place, please contact me at 208-468-3600 or email me at profitsplus@cableone.net.

Bob Coleman

Managing Member, Profits Plus Capital Management, LLC

Friday, October 17, 2008

Taking delivery of 1 to 5 million ounces a month

October 16, 2008

To Mr. Chilton, Commissioner, CFTC and Ms. Troyke, Director and Associate General Counsel, Market Regulation, CME Group:

In full and proper disclosure, I would like to ask the CME/COMEX and CFTC the following question regarding monthly delivery of silver.

I manage a physical gold and silver bullion fund. In order to stay within the “Model State Commodity Code” of many states, an exempt transaction by the purchaser (in this case the Dollars and Sense Growth Fund) must abide by the following code:

A commodity contract for the purchase of one or more precious metals which requires, and under which the purchaser receives, within seven to twenty-eight calendar days (varies depending on the state) from the payment in good funds of any portion of the purchase price, physical delivery of the quantity of the precious metals purchased by such payment, provided that, for purposes of this paragraph, physical delivery shall be deemed to have occurred if, within such 7 to 28 day period (varies depending on the state), such quantity of precious metals purchased by such payment is delivered whether in specifically segregated or fungible bulk form.

In this environment, it has become very difficult and expensive to buy physical silver from the physical dealer market. The difference in paper prices on the Comex and the physical dealer market have widened considerably. In addition, the overwhelming demand for silver has created delivery time delays of up to 4 months. These delivery delays create a direct violation with many Model State Commodity Codes.

My research has led me to the conclusion that it is much more effective and cost efficient to buy silver directly from the COMEX and take full delivery. The spot prices are much cheaper than the dealer market and the CFTC along with the CME/Comex have stated in reports there are ample supplies of silver available for delivery with no market inhibitions. For an individual or institution wanting to accumulate a position, these are ideal market conditions.

The question I have is this:

I would like to buy and take physical delivery of 1 to 5 million ounces of silver a month on a consistent basis. I am not interested in holding warehouse receipts but taking actual physical delivery from your approved depositories/warehouses. Would there be any obstacles or resistence from either the CME Group/COMEX or the CFTC when I begin to implement or during the ongoing process of this strategy?

I look forward to your reply.

Bob Coleman

profitsplus@cableone.net

To Mr. Chilton, Commissioner, CFTC and Ms. Troyke, Director and Associate General Counsel, Market Regulation, CME Group:

In full and proper disclosure, I would like to ask the CME/COMEX and CFTC the following question regarding monthly delivery of silver.

I manage a physical gold and silver bullion fund. In order to stay within the “Model State Commodity Code” of many states, an exempt transaction by the purchaser (in this case the Dollars and Sense Growth Fund) must abide by the following code:

A commodity contract for the purchase of one or more precious metals which requires, and under which the purchaser receives, within seven to twenty-eight calendar days (varies depending on the state) from the payment in good funds of any portion of the purchase price, physical delivery of the quantity of the precious metals purchased by such payment, provided that, for purposes of this paragraph, physical delivery shall be deemed to have occurred if, within such 7 to 28 day period (varies depending on the state), such quantity of precious metals purchased by such payment is delivered whether in specifically segregated or fungible bulk form.

In this environment, it has become very difficult and expensive to buy physical silver from the physical dealer market. The difference in paper prices on the Comex and the physical dealer market have widened considerably. In addition, the overwhelming demand for silver has created delivery time delays of up to 4 months. These delivery delays create a direct violation with many Model State Commodity Codes.

My research has led me to the conclusion that it is much more effective and cost efficient to buy silver directly from the COMEX and take full delivery. The spot prices are much cheaper than the dealer market and the CFTC along with the CME/Comex have stated in reports there are ample supplies of silver available for delivery with no market inhibitions. For an individual or institution wanting to accumulate a position, these are ideal market conditions.

The question I have is this:

I would like to buy and take physical delivery of 1 to 5 million ounces of silver a month on a consistent basis. I am not interested in holding warehouse receipts but taking actual physical delivery from your approved depositories/warehouses. Would there be any obstacles or resistence from either the CME Group/COMEX or the CFTC when I begin to implement or during the ongoing process of this strategy?

I look forward to your reply.

Bob Coleman

profitsplus@cableone.net

Wednesday, July 2, 2008

Precious Metal Storage and Safekeeping Program

Precious Metal Storage and Safekeeping Program

Through Idaho Armored Services

It is my pleasure to introduce you to a very unique storage and safekeeping program exclusively offered through Idaho Armored Services.

Background

Protecting client’s purchasing power in this unique economic climate demands a criterion that is dynamic and forward thinking.

Idaho Armored Services in combination with Profits Plus Capital Management, LLC created the most competitive and comprehensive gold and silver storage program in North America.

Bob Coleman, has been in the investment and portfolio management business for 15 years. During the last 3 years he spent a lot of time talking with experts all over the world regarding inflation and the uncertain economic climate. Obviously, his studies took him to gold and silver. What were not obvious were the methods in which individuals could safely invest and be protected from inflation and the financial system while owning physical precious metals. Although, there are many gold and silver programs in the world, none provided all the characteristics that Bob was looking for.

Idaho Armored’s program was designed around many important issues that investors may have to face. A few factors investors must consider and plan for when owning physical precious metals are:

Elevated inflation

Danger to the financial system

Confiscation

Geo-political or economic event

Protection and insurance

Accessibility

Capital and exchange controls

Idaho Armored Services has planned for these risks and has created a program to protect the client’s interest first.

When owning physical metal the biggest concern is security for the asset. This has detracted many investors from owning the physical gold and silver. Paper gold and silver programs are certainly convenient but in most instances you are investing in the price of the metal not the actual metal.

If you if currently are involved with or looking at these programs, ask yourself the following questions.

Does the bullion vault lease or actually own the gold and silver they say they have?

How fast can companies turn large bars of gold into deliverable ounces?

Unfortunately, when considering these programs most investors do not think about delivery and accessibility of the physical metal. Most programs are betting that you will never take delivery. Therefore these gold and silver program's business plans are not designed for mobility or flexibility. In my opinion, the perfect gold and silver storage program would have the following characteristics:

Clients invest in deliverable form of physical gold and silver bullion.

Have the precious metal stored in an armored and insured vault.

Have the custodian independent from the financial system.

Have arrangements whereby the program has the availability to store metal in other countries.

Offer accessibility to the metal and have prearranged options for delivery if client wants the metal in hand.

Well, there is one program that incorporates all these ideals.

Idaho Armored Services provides flexible storage arrangements, reporting, transportation, and delivery of the metal. Storing large physical quantities of gold and silver outside the financial system is their specialty.

Why is Idaho Armored Services storage program unique?

Not only does Idaho Armored Services have a centralized location, they have created a network of private vaults to store gold and silver anywhere in North America. These relationships include some of the largest security firms in the world. In other words, for the certain investor needing a more localized approach, they can have the physical metal stored in a closer proximity to their location. There are no depositories that can offer this level of service. In addition, Idaho Armored can diversify holdings of gold and silver among regions or countries throughout the world.

Idaho Armored’s management is well diverse and experienced in the security business. As a fully insured armored vault and transportation company, their approach is simple. They will provide a level of service that exceeds the client’s expectations. Whether your needs are transportation of precious metals or private vaulting services, Idaho Armored can design a program that is tailored to your specific needs.

Fees for this premium storage service will be competitive with any major vault service throughout the world. Storage fees for gold and silver may be as low as 55 basis points (of the market value of the metal) depending on quantity and size of bars or coins.

You get what you pay for. Please distinguish all variables when selecting a program. Ask yourself, “Why are you really buying gold and silver?” Ultimately, gold and silver are owned to protect your interests not others. Choose the program that best fits your long-term goals and objectives.

If you have any questions, please email me at idahoarmored@cableone.net or call Bob Coleman at 208-468-3600. References, custody agreement, and certificate of insurance are available upon request.

Through Idaho Armored Services

It is my pleasure to introduce you to a very unique storage and safekeeping program exclusively offered through Idaho Armored Services.

Background

Protecting client’s purchasing power in this unique economic climate demands a criterion that is dynamic and forward thinking.

Idaho Armored Services in combination with Profits Plus Capital Management, LLC created the most competitive and comprehensive gold and silver storage program in North America.

Bob Coleman, has been in the investment and portfolio management business for 15 years. During the last 3 years he spent a lot of time talking with experts all over the world regarding inflation and the uncertain economic climate. Obviously, his studies took him to gold and silver. What were not obvious were the methods in which individuals could safely invest and be protected from inflation and the financial system while owning physical precious metals. Although, there are many gold and silver programs in the world, none provided all the characteristics that Bob was looking for.

Idaho Armored’s program was designed around many important issues that investors may have to face. A few factors investors must consider and plan for when owning physical precious metals are:

Elevated inflation

Danger to the financial system

Confiscation

Geo-political or economic event

Protection and insurance

Accessibility

Capital and exchange controls

Idaho Armored Services has planned for these risks and has created a program to protect the client’s interest first.

When owning physical metal the biggest concern is security for the asset. This has detracted many investors from owning the physical gold and silver. Paper gold and silver programs are certainly convenient but in most instances you are investing in the price of the metal not the actual metal.

If you if currently are involved with or looking at these programs, ask yourself the following questions.

Does the bullion vault lease or actually own the gold and silver they say they have?

How fast can companies turn large bars of gold into deliverable ounces?

Unfortunately, when considering these programs most investors do not think about delivery and accessibility of the physical metal. Most programs are betting that you will never take delivery. Therefore these gold and silver program's business plans are not designed for mobility or flexibility. In my opinion, the perfect gold and silver storage program would have the following characteristics:

Clients invest in deliverable form of physical gold and silver bullion.

Have the precious metal stored in an armored and insured vault.

Have the custodian independent from the financial system.

Have arrangements whereby the program has the availability to store metal in other countries.

Offer accessibility to the metal and have prearranged options for delivery if client wants the metal in hand.

Well, there is one program that incorporates all these ideals.

Idaho Armored Services provides flexible storage arrangements, reporting, transportation, and delivery of the metal. Storing large physical quantities of gold and silver outside the financial system is their specialty.

Why is Idaho Armored Services storage program unique?

Not only does Idaho Armored Services have a centralized location, they have created a network of private vaults to store gold and silver anywhere in North America. These relationships include some of the largest security firms in the world. In other words, for the certain investor needing a more localized approach, they can have the physical metal stored in a closer proximity to their location. There are no depositories that can offer this level of service. In addition, Idaho Armored can diversify holdings of gold and silver among regions or countries throughout the world.

Idaho Armored’s management is well diverse and experienced in the security business. As a fully insured armored vault and transportation company, their approach is simple. They will provide a level of service that exceeds the client’s expectations. Whether your needs are transportation of precious metals or private vaulting services, Idaho Armored can design a program that is tailored to your specific needs.

Fees for this premium storage service will be competitive with any major vault service throughout the world. Storage fees for gold and silver may be as low as 55 basis points (of the market value of the metal) depending on quantity and size of bars or coins.

You get what you pay for. Please distinguish all variables when selecting a program. Ask yourself, “Why are you really buying gold and silver?” Ultimately, gold and silver are owned to protect your interests not others. Choose the program that best fits your long-term goals and objectives.

If you have any questions, please email me at idahoarmored@cableone.net or call Bob Coleman at 208-468-3600. References, custody agreement, and certificate of insurance are available upon request.

Wednesday, February 6, 2008

Credit System Is Broke?

I want to provide yet another example of why physical metal is so important. Mining shares is not the same as owning physical metal. The following will illustrate why you can not blindly trust the system with your financial life. I hope everyone who reads this understands there are serious risks facing the markets today. Please protect yourself and if you own physical gold and silver, think very carefully where you store it.

Look at the non-borrowed reserve column. This represents the depository

institution's assets on their books. The current release shows the

number going negative this past week.

http://www.federalreserve.gov/releases/h3/current/

This has never happened in the 50

years of data (see the historical data link below).

http://www.federalreserve.gov/releases/h3/hist/h3hist1.pdf

The strain in the system and the volatility in the markets represent great stress. In short, these reports show the over-leverage and over-extended financial positions in the banking system.

This report is a great example of why individuals need to own physical metal in order to protect their wealth. I have a great solution to securing and protecting your wealth through physical ownership of gold and silver. Please see my previous articles for more information.

Please feel free to contact me if you have any questions.

Bob Coleman

Look at the non-borrowed reserve column. This represents the depository

institution's assets on their books. The current release shows the

number going negative this past week.

http://www.federalreserve.gov/releases/h3/current/

This has never happened in the 50

years of data (see the historical data link below).

http://www.federalreserve.gov/releases/h3/hist/h3hist1.pdf

The strain in the system and the volatility in the markets represent great stress. In short, these reports show the over-leverage and over-extended financial positions in the banking system.

This report is a great example of why individuals need to own physical metal in order to protect their wealth. I have a great solution to securing and protecting your wealth through physical ownership of gold and silver. Please see my previous articles for more information.

Please feel free to contact me if you have any questions.

Bob Coleman

Subscribe to:

Comments (Atom)